Stock, dividends and bonds

Find information on our share price, dividend schedule and history, and owning PMI stock, as well as information on the company’s outstanding bonds.

Interactive share price graph

Receive email alerts

Sign up for more information from us

Get updates from our Investor Relations team

PMI investment plan

Access computershare

Price lookup

Annual dividend

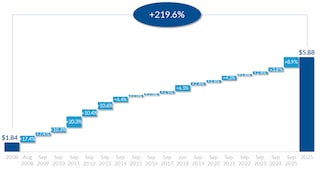

PMI has increased its annual dividend every year since becoming a public company in 2008, representing a total increase of 219.6%, or a compound annual growth rate of 7.1%.

Dividend schedule

Dividends are declared and approved at the discretion of the Board of Directors. The anticipated dividend dates have been adjusted to fit the calendar of Board meetings. Dates chosen for Board meetings take into account a variety of factors, including other items on the corporate calendar and the schedules of Directors.

| DECLARATION DATE | EX-DIVIDEND DATE | RECORD DATE | PAYMENT DATE |

|---|---|---|---|

|

March 6, 2025

|

March 20, 2025

|

March 20, 2025

|

April 10, 2025

|

|

June 13, 2025

|

June 27, 2025

|

June 27, 2025

|

July 15, 2025

|

|

September 19, 2025

|

October 3, 2025

|

October 3, 2025

|

October 20, 2025

|

|

December 12, 2025

|

December 26, 2025

|

December 26, 2025

|

January 14, 20261

|

Dividend payment history

Owning PMI stock

If you hold your shares with a financial institution, such as a bank or broker, and want information about your account, please contact your financial institution directly. If you hold stock certificates or you hold stock in our dividend-reinvestment plan, you can manage your account through services offered via the Investor Center of our transfer agent, Computershare.

Access computershare

Contact details

Computershare Trust Company, N.A.

Address

P.O. Box 43078

Providence, RI 02940-3078

U.S.A.

Phone

+1 877 745 9350

Call toll-free within the U.S. and Canada

+1 781 575 4310

Direct dial from outside the U.S. and Canada

*Bond information

| ISIN Number | Currency | Nominal Amount | Coupon | Issue Date | Maturity Date | Offering Format |

|---|---|---|---|---|---|---|

|

US718172CU19

|

USD

|

750,000,000

|

5.000%

|

Nov 17, 2022

|

Nov 17, 2025

|

S-3 Shelf

|

|

US718172CY31

|

USD

|

1,700,000,000

|

4.875%

|

Feb 15, 2023

|

Feb 13, 2026

|

S-3 Shelf

|

|

US718172BT54

|

USD

|

750,000,000

|

2.750%

|

Feb 25, 2016

|

Feb 25, 2026

|

S-3 Shelf

|

|

XS1040105980

|

EUR

|

1,000,000,000

|

2.875%

|

Mar 03, 2014

|

Mar 03, 2026

|

S-3 Shelf

|

|

US718172CR89

|

USD

|

750,000,000

|

0.875%

|

Nov 02, 2020

|

May 01, 2026

|

S-3 Shelf

|

|

XS2035473748

|

EUR

|

500,000,000

|

0.125%

|

Aug 01, 2019

|

Aug 03, 2026

|

S-3 Shelf

|

|

US718172DF33

|

USD

|

750,000,000

|

4.750%

|

Feb 13, 2024

|

Feb 12, 2027

|

S-3 Shelf

|

|

US718172CB38

|

USD

|

500,000,000

|

3.125%

|

Aug 17, 2017

|

Aug 17, 2027

|

S-3 Shelf

|

|

US718172DM83

|

USD

|

750,000,000

|

4.375%

|

Nov 1, 2024

|

Nov 1, 2027

|

S-3 Shelf

|

|

US718172CV91

|

USD

|

1,500,000,000

|

5.125%

|

Nov 17, 2022

|

Nov 17, 2027

|

S-3 Shelf

|

|

US718172CZ06

|

USD

|

1,550,000,000

|

4.875%

|

Feb 15, 2023

|

Feb 15, 2028

|

S-3 Shelf

|

|

US718172CE76

|

USD

|

500,000,000

|

3.125%

|

Nov 02, 2017

|

Mar 02, 2028

|

S-3 Shelf

|

|

US718172DS53

|

USD

|

400,000,000

|

SOFR + 0.83%

|

Apr 30, 2025

|

Apr 28, 2028

|

S-3 Shelf

|

|

US718172DR70

|

USD

|

750,000,000

|

4.125%

|

Apr 30, 2025

|

Apr 28, 2028

|

S-3 Shelf

|

|

US718172DC02

|

USD

|

650,000,000

|

5.250%

|

Sep 7, 2023

|

Sep 7, 2028

|

S-3 Shelf

|

|

US718172DG16

|

USD

|

1,000,000,000

|

4.875%

|

Feb 13, 2024

|

Feb 13, 2029

|

S-3 Shelf

|

|

XS1066312395

|

EUR

|

500,000,000

|

2.875%

|

May 13, 2014

|

May 14, 2029

|

S-3 Shelf

|

|

XS3087812593

|

EUR

|

500,000,000

|

2.750%

|

Jun 6, 2025

|

Jun 6, 2029

|

S-3 Shelf

|

|

US718172CJ63

|

USD

|

750,000,000

|

3.375%

|

May 01, 2019

|

Aug 15, 2029

|

S-3 Shelf

|

|

US718172DN66

|

USD

|

750,000,000

|

4.625%

|

Nov 1, 2024

|

Nov 1, 2029

|

S-3 Shelf

|

|

US718172CW74

|

USD

|

1,250,000,000

|

5.625%

|

Nov 17, 2022

|

Nov 17, 2029

|

S-3 Shelf

|

|

US718172DA46

|

USD

|

2,200,000,000

|

5.125%

|

Feb 15, 2023

|

Feb 15, 2030

|

S-3 Shelf

|

|

US718172DT37

|

USD

|

750,000,000

|

4.375%

|

Apr 30, 2025

|

Apr 30, 2030

|

S-3 Shelf

|

|

US718172CP24

|

USD

|

750,000,000

|

2.100%

|

May 01, 2020

|

May 01, 2030

|

S-3 Shelf

|

|

US718172DD84

|

USD

|

700,000,000

|

5.500%

|

Sep 7, 2023

|

Sep 7, 2030

|

S-3 Shelf

|

|

US718172CS62

|

USD

|

750,000,000

|

1.750%

|

Nov 02, 2020

|

Nov 01, 2030

|

S-3 Shelf

|

|

XS2837884746

|

EUR

|

500,000,000

|

3.750%

|

Jun 6, 2024

|

Jan 15, 2031

|

S-3 Shelf

|

|

US718172DH98

|

USD

|

1,250,000,000

|

5.125%

|

Feb 13, 2024

|

Feb 13, 2031

|

S-3 Shelf

|

|

XS2035474126

|

EUR

|

750,000,000

|

0.800%

|

Aug 01, 2019

|

Aug 01, 2031

|

S-3 Shelf

|

|

US718172DP15

|

USD

|

750,000,000

|

4.750%

|

Nov 1, 2024

|

Nov 1, 2031

|

S-3 Shelf

|

|

XS3087812833

|

EUR

|

500,000,000

|

3.250%

|

Jun 6, 2025

|

Jun 6, 2032

|

S-3 Shelf

|

|

US718172CX57

|

USD

|

1,500,000,000

|

5.750%

|

Nov 17, 2022

|

Nov 17, 2032

|

S-3 Shelf

|

|

US718172DB29

|

USD

|

2,250,000,000

|

5.375%

|

Feb 15, 2023

|

Feb 15, 2033

|

S-3 Shelf

|

|

XS0940697187

|

EUR

|

500,000,000

|

3.125%

|

Jun 03, 2013

|

Jun 03, 2033

|

S-3 Shelf

|

|

US718172DE67

|

USD

|

1,000,000,000

|

5.625%

|

Sep 7, 2023

|

Sep 7, 2033

|

S-3 Shelf

|

|

US718172DJ54

|

USD

|

1,750,000,000

|

5.250%

|

Feb 13, 2024

|

Feb 13, 2034

|

S-3 Shelf

|

|

US718172DQ97

|

USD

|

750,000,000

|

4.900%

|

Nov 1, 2024

|

Nov 1, 2034

|

S-3 Shelf

|

|

US718172DU00

|

USD

|

600,000,000

|

4.875%

|

Apr 30, 2025

|

Apr 30, 2035

|

S-3 Shelf

|

|

XS1408421763

|

EUR

|

500,000,000

|

2.000%

|

May 09, 2016

|

May 09, 2036

|

S-3 Shelf

|

|

XS1716245094

|

EUR

|

500,000,000

|

1.875%

|

Nov 08, 2017

|

Nov 06, 2037

|

S-3 Shelf

|

|

US718172AC39

|

USD

|

1,500,000,000

|

6.375%

|

May 16, 2008

|

May 16, 2038

|

S-3 Shelf

|

|

XS2035474555

|

EUR

|

750,000,000

|

1.450%

|

Aug 01, 2019

|

Aug 01, 2039

|

S-3 Shelf

|

|

US718172AM11

|

USD

|

750,000,000

|

4.375%

|

Nov 15, 2011

|

Nov 15, 2041

|

S-3 Shelf

|

|

US718172AP42

|

USD

|

700,000,000

|

4.500%

|

Mar 20, 2012

|

Mar 20, 2042

|

S-3 Shelf

|

|

US718172AU37

|

USD

|

750,000,000

|

3.875%

|

Aug 21, 2012

|

Aug 21, 2042

|

S-3 Shelf

|

|

US718172AW92

|

USD

|

850,000,000

|

4.125%

|

Mar 04, 2013

|

Mar 04, 2043

|

S-3 Shelf

|

|

US718172BD03

|

USD

|

750,000,000

|

4.875%

|

Nov 12, 2013

|

Nov 15, 2043

|

S-3 Shelf

|

|

US718172BL29

|

USD

|

1,250,000,000

|

4.250%

|

Nov 10, 2014

|

Nov 10, 2044

|

S-3 Shelf

|

* The list does not include notes issued by Swedish Match AB

Sign up for more information from PMI's Investor Relations team.

Get updates from our Investor Relations team

New PMI Investor Relations mobile app is now available

Our newly designed Investor Relations mobile application provides users with easier, more dynamic and comprehensive access to the company’s Investor Relations information, such as stock quotes, press releases, SEC filings, investor materials, and live and archived webcast playback of earnings calls and investor presentations.